HERRAMIENTAS DE MARKETING DE IA

Saluda a tu asistente de crecimiento de IA

Intuit Assist funciona en todas las plataformas de Intuit, incluida Mailchimp, para ayudarte a abordar las partes manuales del marketing, desde convertir los datos en información procesable hasta producir contenido personalizado a escala.*

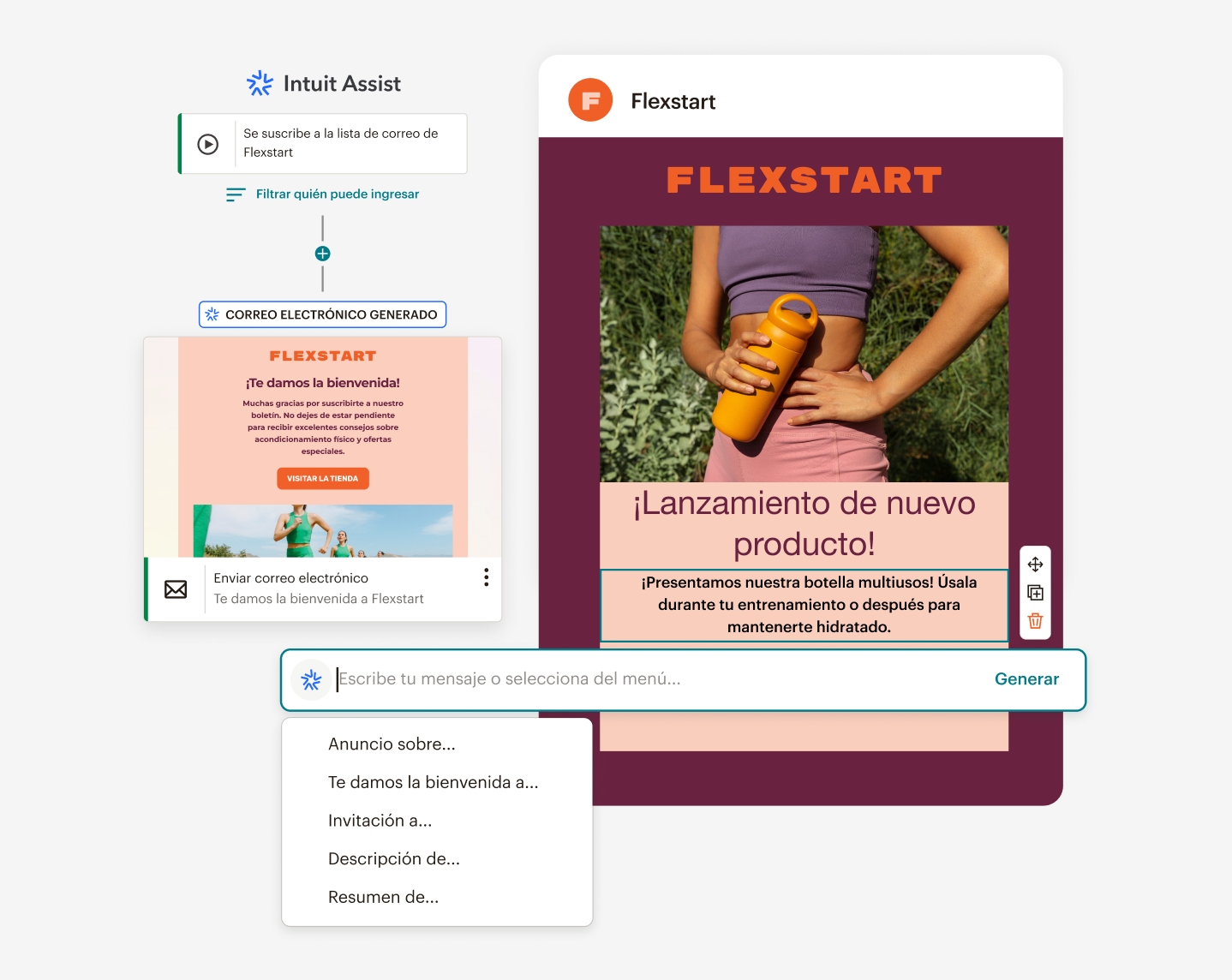

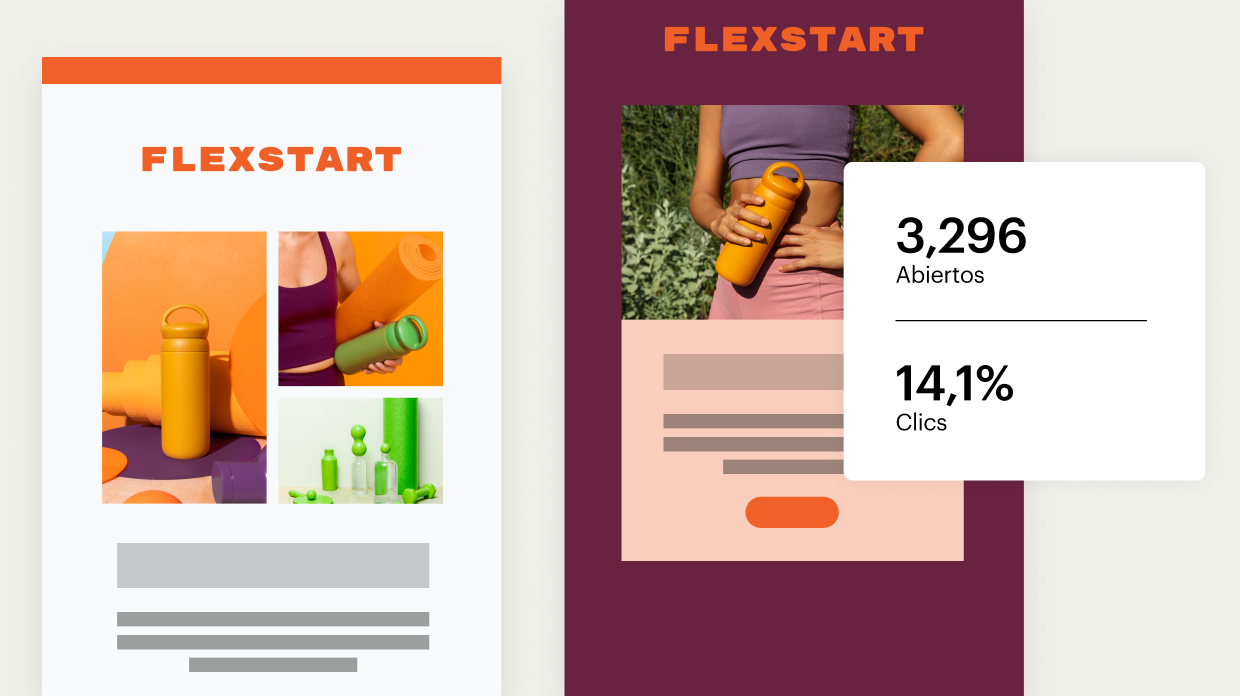

Automatiza campañas personalizadas a escala

Da la bienvenida a nuevos contactos, recupera carritos abandonados y gana de nuevo clientes perdidos con automatizaciones generadas por IA y correos electrónicos completamente redactados que solo necesitas revisar y publicar.

Observa hasta un 115% de aumento en la tasa de clics con correos electrónicos automatizados integrados en el Creador de recorridos del cliente en comparación con los correos electrónicos masivos*

Deja que la IA te ayude a encontrar y obtener ingresos que aún no has explotado

Pronto, nuestros modelos de IA podrán predecir qué clientes tienen más probabilidades de hacer una conversión y ayudarte a dirigirte a ellos sugiriéndote contenido de marketing personalizado y de alta calidad.

Deja que Intuit Assist escriba el primer borrador*

Cuando permites que la IA genere correos electrónicos y copias de la marca, envías contenido relevante más rápido. Solo tienes que revisar, editar y enviar.

Premium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

† Se aplican recargos si se supera el límite de contactos o de envío de correos electrónicos. El envío del plan Free se pausará si se supera el límite de contactos o de envío de correos electrónicos.

Más informaciónPremium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

*Ver

Oferta Términos.*Se aplican recargos si se supera el límite de contactos o de envío de correos electrónicos. El envío del plan Free se pausará si se supera el límite de contactos o de envío de correos electrónicos.

Más informaciónPremium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

*Ver

Oferta Términos.*Se aplican recargos si se supera el límite de contactos o de envío de correos electrónicos. El envío del plan Free se pausará si se supera el límite de contactos o de envío de correos electrónicos.

Más informaciónPremium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

† Se aplican recargos si se supera el límite de contactos o de envío de correos electrónicos. El envío del plan Free se pausará si se supera el límite de contactos o de envío de correos electrónicos.

Más informaciónImpulsa el marketing personalizado mediante el uso de herramientas de ciencia de datos junto con Intuit Assist

Nuestras herramientas de ciencia de datos te ayudan a dar lo mejor de ti con tus correos electrónicos.*

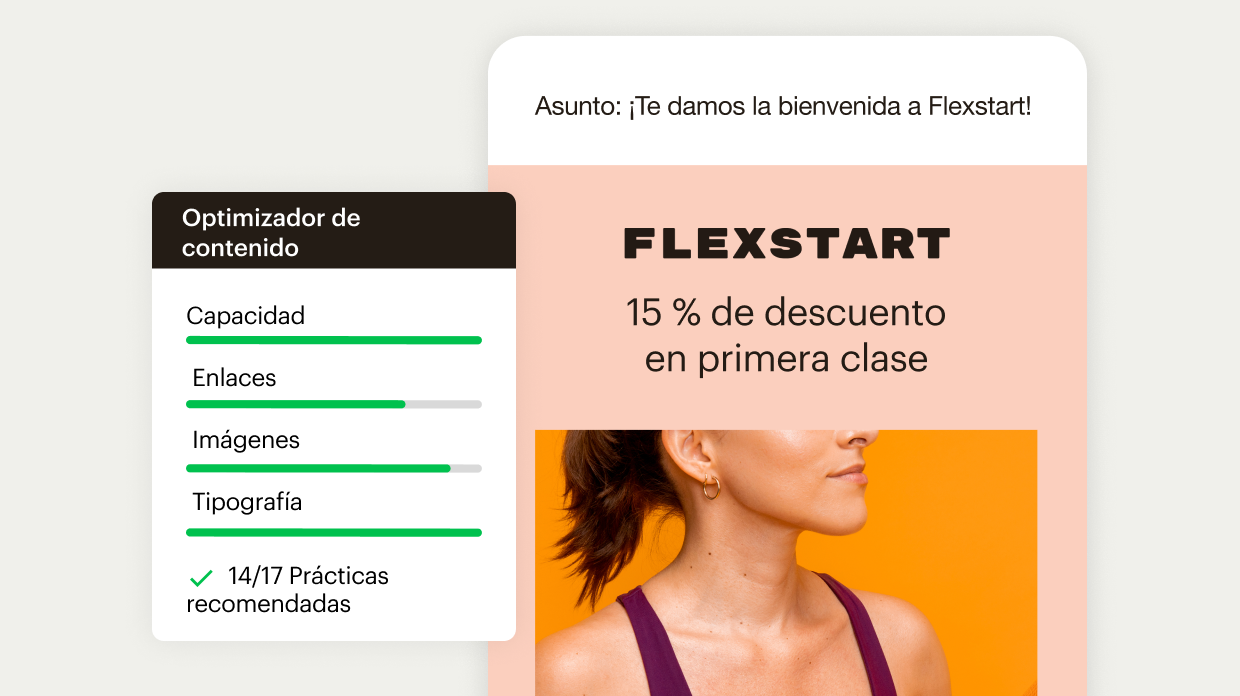

Obtén recomendaciones para mejorar el contenido de tus correos electrónicos

Analiza tus campañas y obtén sugerencias personalizadas sobre qué mejorar.

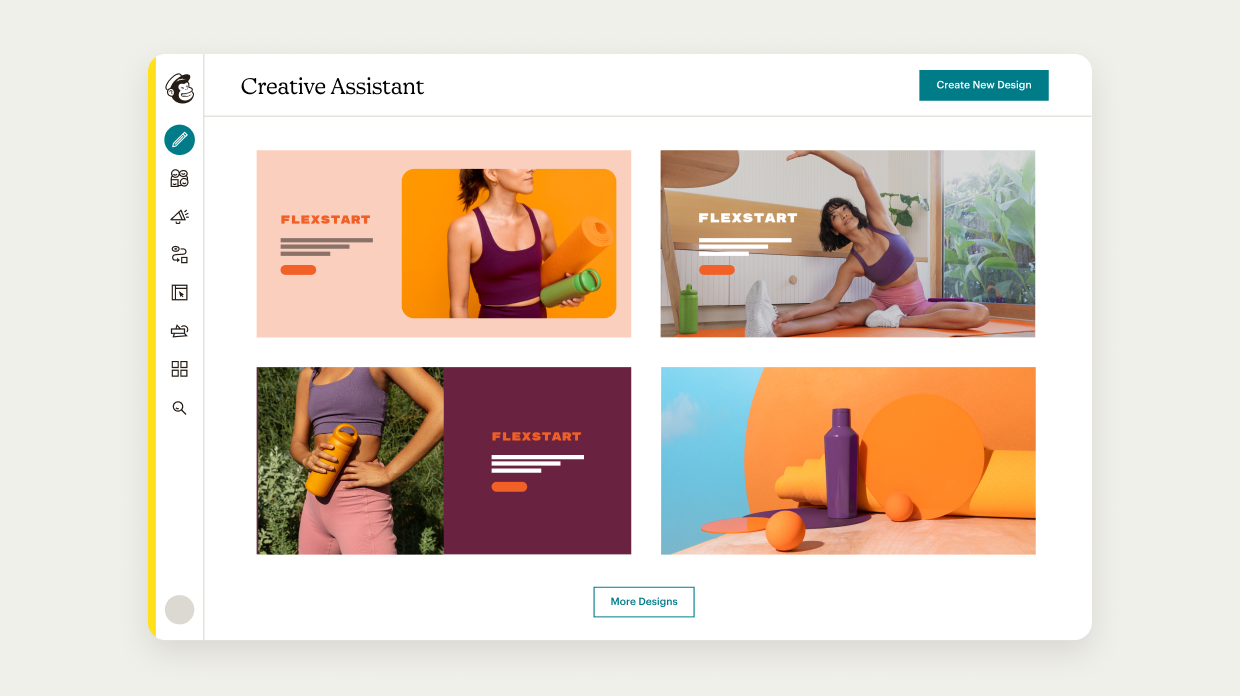

Genera diseños de marca

Utiliza la IA para crear diseños personalizados por medio de colores, tipografías, logos e imágenes de tu marca.

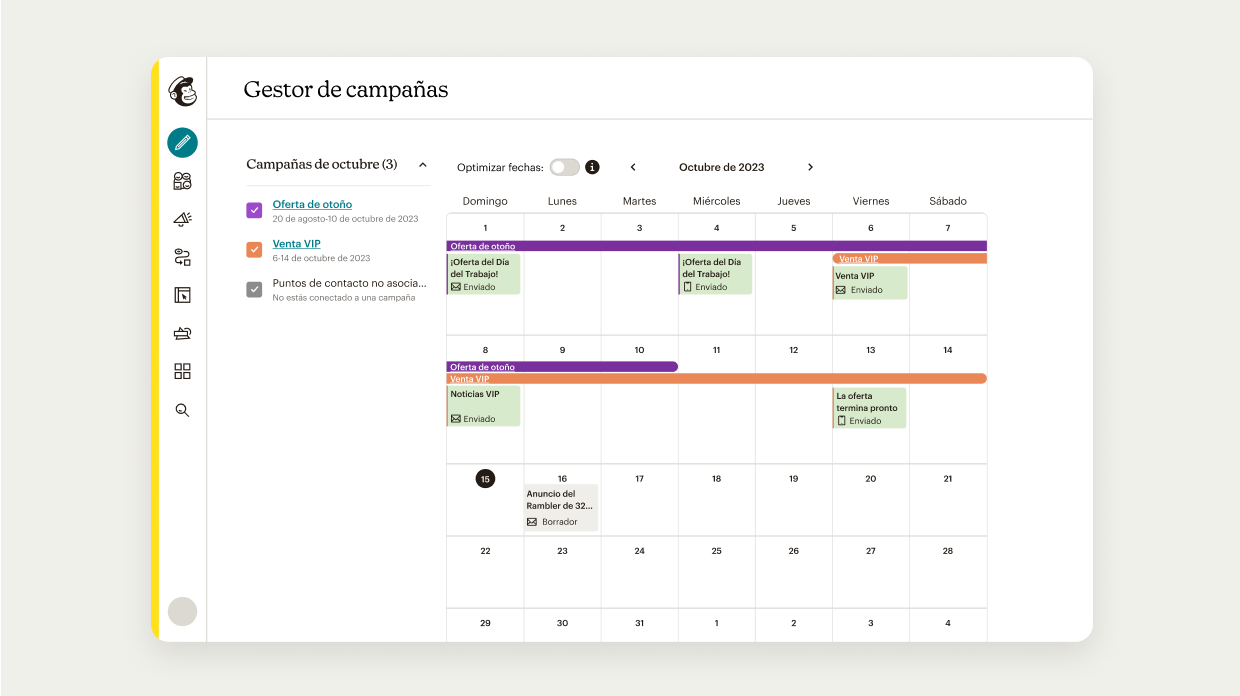

Envía en el momento adecuado

Envía campañas en los mejores días y horarios previstos para la interacción.

Envía contenido que funcione

Prueba diferentes versiones de contenido con las pruebas A/B.

“La copia es un punto de partida perfecto y realizar cambios lleva sólo unos minutos en lugar de media hora. Es como tener ese asistente digital que te permite convertirte en editor en lugar de escritor”.

Jack Tadd, directora de contenidos, Warm Glass UK

Preguntas frecuentes

-

Al iniciar una campaña de email marketing, es importante escribir un buen contenido. El texto de tu contenido de email marketing representará la voz de tu marca e invitará al lector a realizar una acción deseada. Aquí tienes algunos consejos para escribir un gran contenido de email marketing:

Que sea breve: es posible que no tengas la atención del lector por mucho tiempo, así que asegúrate de condensar tu mensaje e ir al grano. Escribe una buena línea de asunto: una línea de asunto es lo primero que ve un lector, por lo que si es buena, la persona abrirá tu correo electrónico en primer lugar. Incluye una llamada a la acción: todo contenido de marketing por correo electrónico debe incluir una llamada a la acción, ya sea que quieras que el lector compre en tu sitio web o que lea tu última publicación en el blog.

-

Para crear un segmento sencillo en Mailchimp, haz clic en Público, selecciona Segmentos, elige tu público y haz clic en Crear segmento. Desde ahí, ajusta el menú desplegable a Fecha en que se añadió es posterior a cuando se envió la última campaña. Asegúrate de previsualizar tu segmento antes de darle un nombre y guardarlo.

-

Tanto si un comprador potencial está al principio de su recorrido de compra como si ha llegado al proceso de pago, el Creador de recorridos del cliente puede ayudarte a conseguir la venta. El Creador de recorridos del cliente de Mailchimp te permite crear y automatizar un proceso de trabajo adaptado a tu negocio. Para empezar, asegúrate de tener acceso a nuestras herramientas de recorrido del cliente en tu plan actual.

Ve a la página de inicio de Recorridos del cliente y selecciona Crear desde cero o utiliza los mapas prediseñados que están disponibles. A continuación, haz clic en el botón Empieza a crear.

-

Los análisis de correo electrónico proporcionan información muy útil que te permite identificar lo que funciona para tu negocio y perfeccionar las campañas que se pueden mejorar aún más. A veces, los datos proporcionados pueden ser difíciles de descifrar, pero siempre recibirás información digerible y fácil de leer con nuestro software de informes de marketing digital.

Nuestras herramientas de análisis e informes funcionan al controlar la interacción, el crecimiento y los ingresos de tus campañas en los distintos canales. Esto incluye los correos electrónicos, los anuncios en redes sociales, los códigos de promoción utilizados, etc. Como resultado, conocerás con precisión lo que les gusta a tus clientes y podrás seguir creando contenido que se ajuste a sus necesidades. Las herramientas de informes de marketing digital también te permiten ver cómo se comparan tus campañas de correo electrónico con las de la competencia. Lo mejor es que puedes hacerlo sin salir del panel de control de análisis de Mailchimp.

* Exención de responsabilidad

- Intuit Assist : la funcionalidad Intuit Assist (beta) está disponible para ciertos usuarios con planes Premium, Standard y Legacy en determinados países solo en inglés. El acceso a Intuit Assist está disponible sin costo adicional en este momento. Los precios, términos, condiciones, funciones especiales y opciones de servicio están sujetos a cambios sin previo aviso. La disponibilidad de las funciones y la funcionalidad varían según el tipo de plan. Las funciones pueden estar ampliamente disponibles pronto, pero no representan ninguna obligación y no se debe confiar en estas para tomar una decisión de compra. Para obtener más información, consulta los distintos planes y precios de Mailchimp.

- Tasa de clics de hasta 115%: para el período del 1 de septiembre de 2020 al 10 de octubre de 2023. Las funciones y la funcionalidad de CJB varían según el plan.

- Optimizador de contenido: el Optimizador de contenido solo está disponible en los planes Standard o Premium.

- La disponibilidad de las características y la funcionalidad varía según el tipo de plan. Para obtener más información, consulta los distintos planes y precios de Mailchimp.