Squarespace Commerce

Comercializa tu negocio de E-Commerce e impulsa las ventas cuando conectes tu comercio de Squarespace y los datos de tu sitio web a Mailchimp.*

- Precio

- Gratis

- Desarrollador

- Mailchimp

- Idiomas

- English, French, German, Italian, Portuguese, Spanish

-

#1

plataforma de email marketing y automatización*

-

8 millones

recomendaciones respaldadas por datos y generadas con herramientas basadas en IA*.

-

500 millones

correos electrónicos enviados cada día (promedio)

-

> 99% correo electrónico

de entregabilidad del correo electrónico (promedio)

Habla directamente a tu público y ofrece contenido que genere conversiones con la integración de Squarespace Commerce

Convierte más, con más información

Tus clientes son únicos. Personaliza tu marketing a escala con datos extraídos directamente de tu tienda online y ofrece contenidos que generen resultados.

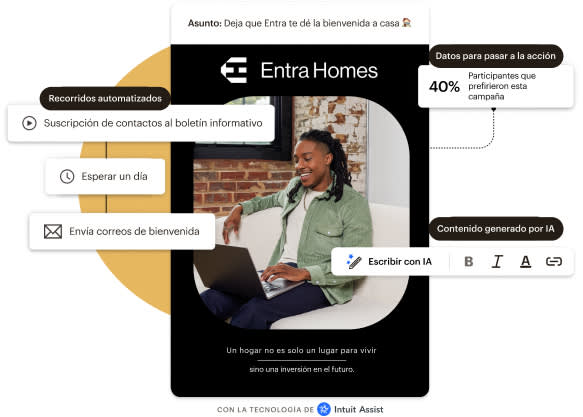

Acelera tu crecimiento con la automatización

Aprovecha el poder de la IA para dar la bienvenida a nuevos contactos, recuperar carritos abandonados y ganar clientes perdidos con automatizaciones y correos electrónicos completamente integrados.

Conectar Mailchimp a Squarespace

Lleva tus datos de clientes e información de pedidos de Squarespace a tus públicos de Mailchimp. Realiza un seguimiento de las ventas, crea automatizaciones de E-Commerce específicas, envía correos electrónicos de carritos abandonados y más.

¿Qué hace?

Estas son algunas formas populares de usar esta integración. Sus funciones y características varían según el plan.

-

Convierte con información basada en IA

- Desarrolla una estrategia de marketing fundamentada con información procesable derivada del comportamiento del cliente.

- Usa informes y paneles personalizados para realizar un seguimiento de las ventas y el rendimiento de la campaña.

- Dirígete a tus clientes en función de su probabilidad de compra con la segmentación predictiva.

-

Gestiona y haz crecer las relaciones con los clientes

- Capta contactos y suscriptores desde tu sitio de Squarespace Commerce y sincronízalos con tu público de Mailchimp.

- Recopila y organiza a todos tus clientes y contactos en un potente CRM de marketing.

- Etiqueta y segmenta a tu público para campañas de marketing personalizadas.

-

Impulsa tu interacción multicanal rápidamente

- Interactúa con tu público en todos los canales con correo electrónico, mensajes SMS y redes sociales.*

- Crea potentes automatizaciones para ofrecer un marketing multicanal rápido y atractivo.

- Envía mensajes específicos con facilidad, directamente desde Mailchimp.

-

Crear contenido personalizado con IA

- Usa las herramientas de creación de contenido impulsadas por IA de Mailchimp para sugerir contenido personalizado a gran escala.

- Aprovecha el poder de Intuit Assist para crear contenido basado en la intención que resuene con tu público.

- Obtén sugerencias personalizadas para mejorar el texto, las imágenes y el diseño en futuros correos electrónicos.

Artículos sobre recursos

Millones de usuarios nos confían su marketing. Tú también puedes hacerlo.

* Exención de responsabilidad

- Integración: Mailchimp y Squarespace se venden por separado. Integración disponible. La disponibilidad de las funciones y la funcionalidad varían según el tipo de plan. Para más detalles, consulta los planes y precios de Mailchimp.

- La mejor plataforma de email marketing y automatización: Mailchimp es la mejor plataforma de email marketing y automatización, de acuerdo con los datos disponibles públicamente de 2023 sobre la cantidad de clientes de los competidores.

- Más de 8 millones de recomendaciones respaldadas por datos: Basadas en datos de 2022 de los siguientes productos: Recomendaciones de productos, Optimización de la hora de envío, Pruebas A/B, Segmentación del CLV, Segmentación de probabilidad de compra y PBJ.

- Marketing por SMS: los SMS están disponibles como complemento de los planes de pago en determinados países. Se requiere una solicitud y la aceptación de los términos antes de comprar créditos. Los mensajes solo pueden entregarse a los contactos en el país seleccionado. La mensajería de Australia está disponible solo para contactos con código de país +61. Los créditos de SMS se agregan a tu cuenta después de la compra y la aprobación. Los créditos se emiten mensualmente, y los créditos no utilizados caducan y no se acumulan. Los MMS solo están disponibles para los planes Standard y Premium que envías a contactos de EE. UU. y Canadá. Los precios varían. Haz clic aquí para más detalles.

- Intuit Assist: la funcionalidad Intuit Assist (beta) está disponible para ciertos usuarios con planes Premium, Standard y Legacy en determinados países solo en inglés. El acceso a Intuit Assist está disponible sin costo adicional en este momento. Los precios, términos, condiciones, funciones especiales y opciones de servicio están sujetos a cambios sin previo aviso. La disponibilidad de las funciones y la funcionalidad varían según el tipo de plan. Las funciones pueden estar ampliamente disponibles pronto, pero no representan ninguna obligación y no se debe confiar en estas para tomar una decisión de compra. Para obtener más información, consulta los distintos planes y precios de Mailchimp.