HERRAMIENTAS DE CREACIÓN DE CONTENIDO

Impulsa la interacción, genera confianza y gana lealtad con las herramientas de creación de contenido asistidas por IA

Nuestra plataforma, líder en el sector, emplea la IA para sugerir creatividades de marketing que tu equipo puede emplear para crear fácilmente contenido de marketing único y personalizado.*

Descubre por qué somos los mejores en nuestro sector

La plataforma n.º 1 de email marketing y automatizaciones con tecnología de IA que recomienda maneras de obtener más aperturas, clics y ventas.

-

Hasta 25 veces el ROI

visto por usuarios de Mailchimp*

-

> tasa de entregabilidad del 99%

para correo electrónico (promedio)

-

Más de 11 millones de usuarios

de Mailchimp en todo el mundo

-

Más de 50 activadores basados en el comportamiento

para personalización

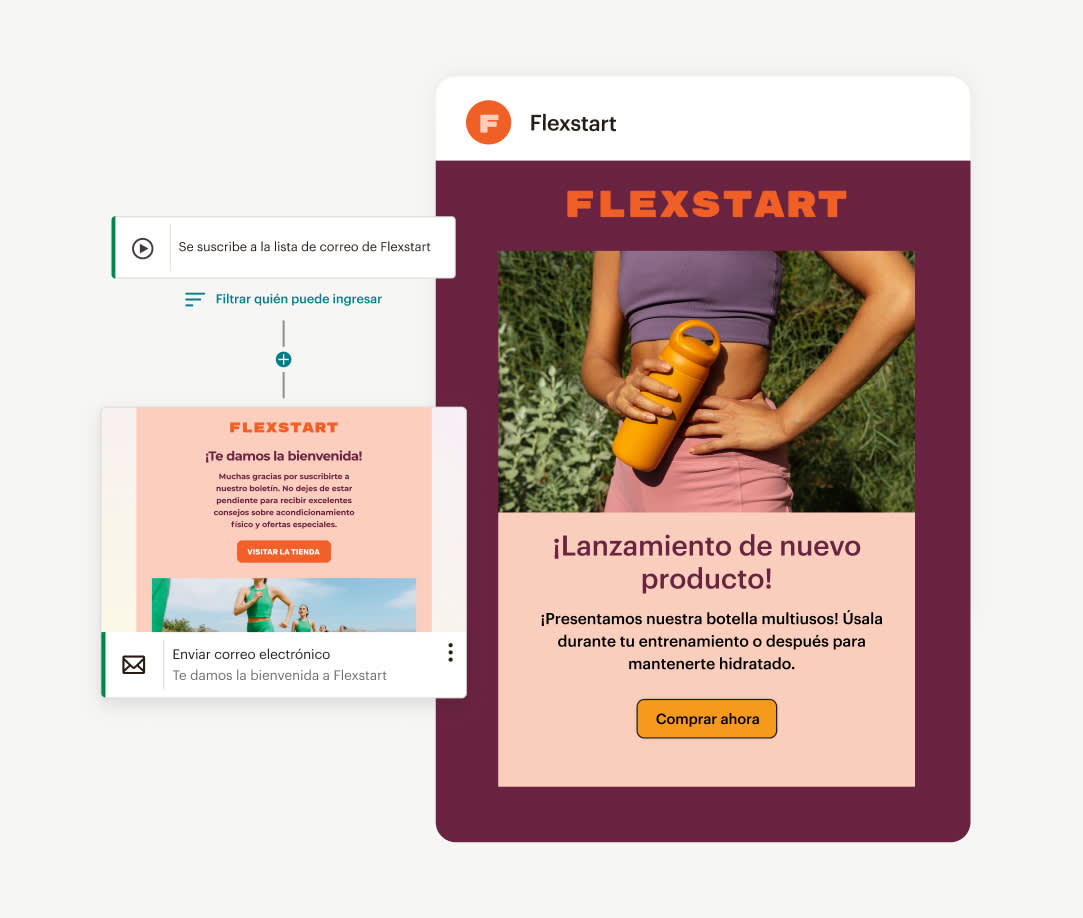

Crea contenido que cautive y convierta

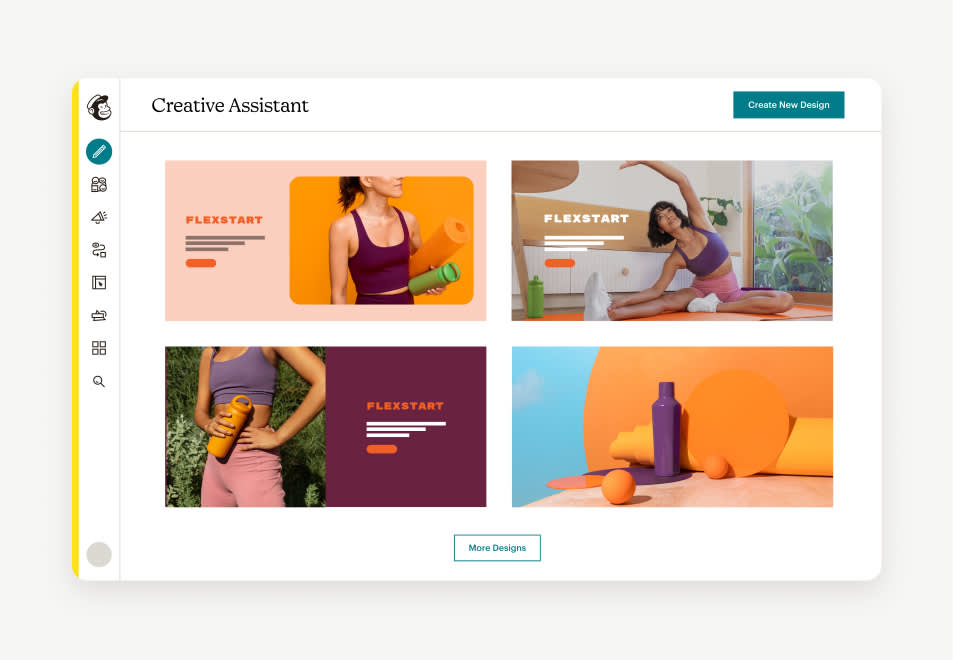

Genera diseños cohesivos rápidamente

Con la plataforma impulsada por IA de Mailchimp, tu equipo puede crear experiencias gratificantes y congruentes que garanticen que tus campañas deleiten a tus clientes e impulsen las conversiones.

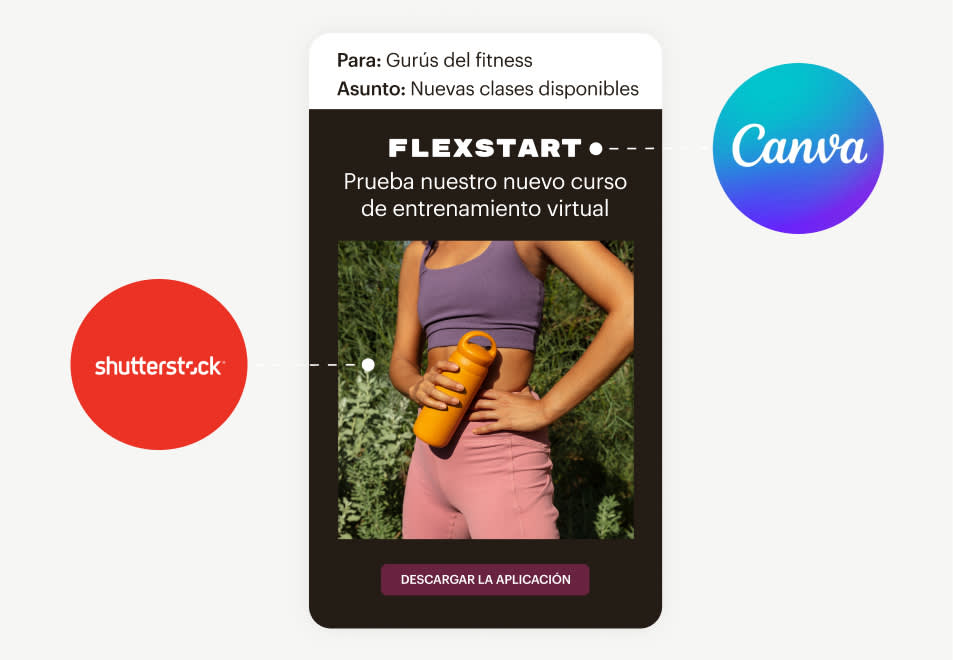

Eleva tu marca con Canva, Shutterstock y más

Las integraciones perfectas ponen una variedad de recursos creativos al alcance de tu mano. Importa tus diseños únicos de Canva y accede a más de 2 millones de imágenes gratis de Shutterstock, y eso es solo el comienzo.

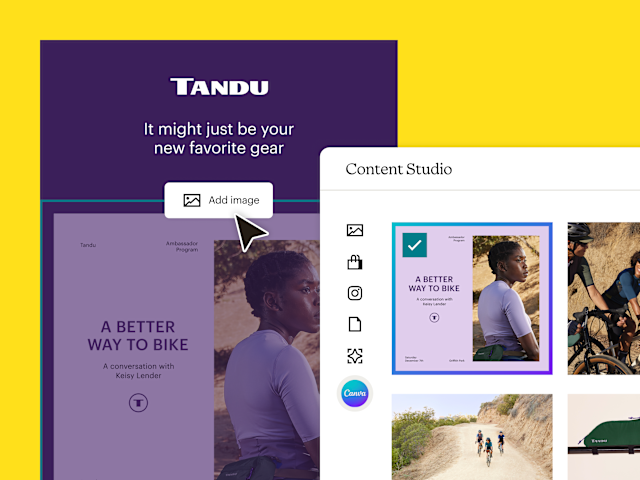

Eleva la gestión de tu marca con la integración de Canva y Mailchimp

Ahorra tiempo y crea correos electrónicos increíbles, accede a los diseños de tu marca de Canva, directamente dentro de Mailchimp. Realiza el diseño de forma más rápida y sencilla con un cómodo acceso a elementos visuales atractivos.

“También usamos Content Optimizer cada vez que enviamos porque nos da recomendaciones para nuestro próximo correo electrónico. Miramos ese informe y vemos qué podemos hacer mejor la próxima vez según las recomendaciones de Mailchimp... Creo que las herramientas de Mailchimp son fantásticas en todos los ámbitos”.

-Billy Lesnak, director de Marketing de Steel City Collectibles US

Prueba, comprende y optimiza tu contenido con Mailchimp

Aumenta la interacción con recomendaciones basadas en datos

Nuestra plataforma analiza millones de campañas de alto rendimiento en tu industria para ofrecer sugerencias personalizadas sobre cómo mejorar el texto, las imágenes, el diseño y mucho más.

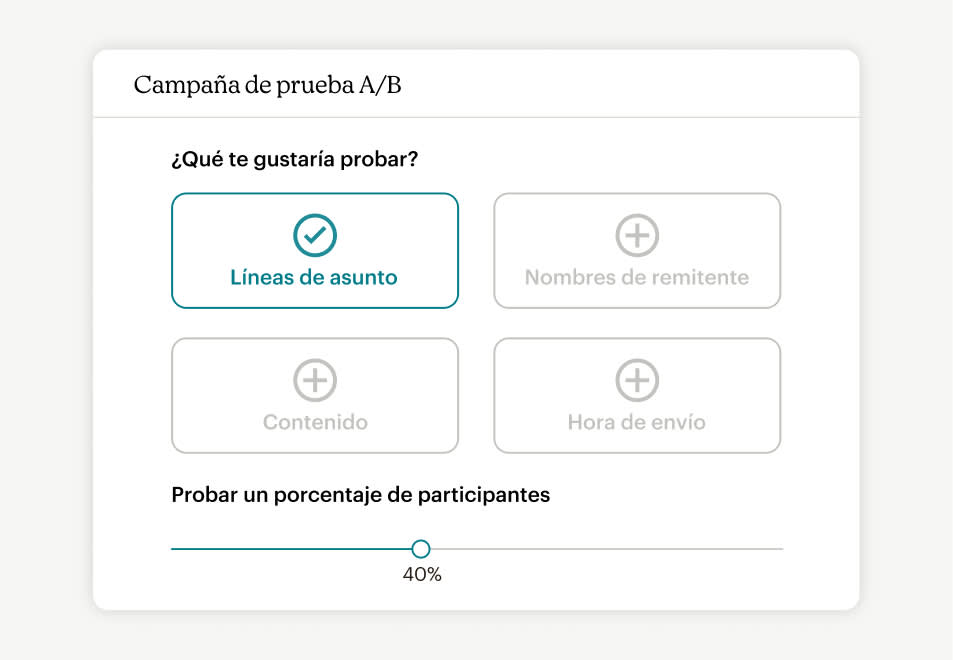

Usa las pruebas A/B para descubrir lo que tu público realmente quiere

Mailchimp ayuda a eliminar las conjeturas a la hora de crear campañas. Con las pruebas A/B, puedes experimentar con diferentes líneas de asunto, textos, imágenes y mucho más para determinar qué impulsa la interacción y motiva a los clientes a actuar.

Premium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

Standard

Vende aún más con personalización, herramientas de optimización y automatizaciones mejoradas.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $130 al mes para {contacts} contactos

- Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas y codificadas personalizadas

- Pruebas A/B y multivariantes

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado

- Segmentación predictiva

- Orientación conductual

Essentials

Envíe el contenido correcto en el momento adecuado con funciones de prueba y programación.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $85 al mes para {contacts} contactos

- 24/7 Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas

- Pruebas A/B

- Recorridos del cliente automatizados básicos

-

Onboarding personalizado

-

Segmentación predictiva

-

Orientación conductual

Free

Crea fácilmente campañas de correo electrónico y aprende más sobre tus clientes.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Desde $0 al mes para {contacts} contactos

- Soporte por correo electrónico durante los primeros 30 días

- Plantillas de correo electrónico prediseñadas

-

Pruebas A/B

-

Recorridos automatizados del cliente básicos

-

Onboarding

-

Segmentación predictiva

-

Orientación conductual

† Se aplican recargos si se supera el límite de contactos o de envío de correos electrónicos. El envío del plan Free se pausará si se supera el límite de contactos o de envío de correos electrónicos.

Más informaciónPremium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

Standard

Vende aún más con personalización, herramientas de optimización y automatizaciones mejoradas.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $130 al mes para {contacts} contactos

- Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas y codificadas personalizadas

- Pruebas A/B y multivariantes

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado

- Segmentación predictiva

- Orientación conductual

Essentials

Envíe el contenido correcto en el momento adecuado con funciones de prueba y programación.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $85 al mes para {contacts} contactos

- 24/7 Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas

- Pruebas A/B

- Recorridos del cliente automatizados básicos

-

Onboarding personalizado

-

Segmentación predictiva

-

Orientación conductual

Free

Crea fácilmente campañas de correo electrónico y aprende más sobre tus clientes.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Desde $0 al mes para {contacts} contactos

- Soporte por correo electrónico durante los primeros 30 días

- Plantillas de correo electrónico prediseñadas

-

Pruebas A/B

-

Recorridos automatizados del cliente básicos

-

Onboarding

-

Segmentación predictiva

-

Orientación conductual

*Ver

Oferta Términos.***** aplican excesiones si se excede el límite de envío de contacto o correo electrónico. El envío gratuito del plan se pausará si se excede el límite de envío de contacto o correo electrónico.

aprender másPremium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

Standard

Vende aún más con personalización, herramientas de optimización y automatizaciones mejoradas.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $130 al mes para {contacts} contactos

- Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas y codificadas personalizadas

- Pruebas A/B y multivariantes

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado

- Segmentación predictiva

- Orientación conductual

Essentials

Envíe el contenido correcto en el momento adecuado con funciones de prueba y programación.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $85 al mes para {contacts} contactos

- 24/7 Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas

- Pruebas A/B

- Recorridos del cliente automatizados básicos

-

Onboarding personalizado

-

Segmentación predictiva

-

Orientación conductual

Free

Crea fácilmente campañas de correo electrónico y aprende más sobre tus clientes.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Desde $0 al mes para {contacts} contactos

- Soporte por correo electrónico durante los primeros 30 días

- Plantillas de correo electrónico prediseñadas

-

Pruebas A/B

-

Recorridos automatizados del cliente básicos

-

Onboarding

-

Segmentación predictiva

-

Orientación conductual

*Ver

Oferta Términos.***** aplican excesiones si se excede el límite de envío de contacto o correo electrónico. El envío gratuito del plan se pausará si se excede el límite de envío de contacto o correo electrónico.

aprender másPremium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

Standard

Vende aún más con personalización, herramientas de optimización y automatizaciones mejoradas.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $130 al mes para {contacts} contactos

- Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas y codificadas personalizadas

- Pruebas A/B y multivariantes

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado

- Segmentación predictiva

- Orientación conductual

Essentials

Envíe el contenido correcto en el momento adecuado con funciones de prueba y programación.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $85 al mes para {contacts} contactos

- 24/7 Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas

- Pruebas A/B

- Recorridos del cliente automatizados básicos

-

Onboarding personalizado

-

Segmentación predictiva

-

Orientación conductual

Free

Crea fácilmente campañas de correo electrónico y aprende más sobre tus clientes.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Desde $0 al mes para {contacts} contactos

- Soporte por correo electrónico durante los primeros 30 días

- Plantillas de correo electrónico prediseñadas

-

Pruebas A/B

-

Recorridos automatizados del cliente básicos

-

Onboarding

-

Segmentación predictiva

-

Orientación conductual

† Se aplican recargos si se supera el límite de contactos o de envío de correos electrónicos. El envío del plan Free se pausará si se supera el límite de contactos o de envío de correos electrónicos.

Más informaciónNovedades en Mailchimp

Ofrece experiencias personalizadas de manera eficiente, y genera ingresos con nuestro nuevo y avanzado asistente de IA y funciones de SMS.

Más información sobre la creación de contenido

Preguntas frecuentes

-

Los creadores de contenido necesitan una variedad de herramientas para crear contenido de alta calidad. Un buen kit de herramientas de creación de contenido debe incluir estas sencillas herramientas:

- Herramientas de investigación de contenido para obtener información e identificar tendencias de Google

- Un asistente de IA para ayudar a encontrar ideas de contenido

- Una herramienta de edición y un revisor de gramática para evitar errores de sinsentidos

- Una herramienta de diseño gráfico para añadir imágenes de alta calidad y dar vida a tu mensaje

- Herramientas de creación de contenido de video para dar a tu contenido una dimensión adicional

Aprovecha tu contenido con una buena investigación de palabras clave de SEO, y asegúrate de que tenga una clasificación alta y obtenga la exposición deseada. Los creadores de contenido más avanzados con habilidades para probar archivos de audio pueden considerar ampliar su alcance con herramientas de pódcast. Por último, mantente organizado con una herramienta de planificación de contenido. Una buena herramienta de gestión de proyectos te ayudará a programar y crear contenido regularmente.

Para estas herramientas básicas, la mayoría de las empresas ofrecen una versión gratuita, con la opción de actualizar a un plan de pago. Mailchimp ofrece algunas de las mejores herramientas de creación de contenido, como Creative Assistant, las plantillas de correo electrónico, el asistente de línea de asunto, el gestor de contenido y las herramientas de IA generativas.

-

Las herramientas de creación de contenido digital ayudan a los profesionales de marketing a desarrollar contenido para sus canales de marketing digital, desde publicaciones en redes sociales hasta campañas por correo electrónico y pódcast. Esto incluye herramientas de redacción, edición y diseño profesional, incluido el proceso de creación de videos. La mayoría de las empresas ofrecen versiones gratuitas y de pago de sus herramientas.

-

Los especialistas en marketing digital pueden aprovechar las herramientas de creación de contenido para construir su marca, amplificar su mensaje y expandir su público. Mailchimp ofrece herramientas de creación de contenido para ayudarte a escribir, diseñar, optimizar y programar contenido.

-

Cuando se trata de crear contenido atractivo para múltiples canales de marketing, a menudo es difícil saber por dónde empezar. Crear contenido destacado puede parecer una tarea abrumadora.

El generador de textos de IA y Creative Assistant de Mailchimp son las herramientas de creación de contenido más populares para iniciar el proceso de creación de contenido.

- El generador de textos de IA es una herramienta magnífica para proporcionar ideas de contenido inspiradas, con recomendaciones personalizadas basadas en datos específicos para tu sector y propósito.

- Creative Assistant te permite ahorrar tiempo mediante el conocimiento de tu marca para luego crear diseños personalizados al instante.

-

La creación de contenido es una forma crucial para que las empresas interactúen con su público y lo hagan crecer. Este aspecto del marketing digital no debe desatenderse. Un proceso de creación de contenido cuidadosamente planificado, basado en ideas de contenido de marca, puede lograr que los clientes actuales interactúen y atraer a nuevos clientes.

-

El proceso de creación de contenido comienza con la investigación de las tendencias del sector, lo que ayuda a generar ideas estratégicas sobre temas. Puede adoptar diferentes formatos de contenido, incluido contenido escrito, como artículos de blog, clips de video y publicaciones en redes sociales, campañas de correo electrónico e incluso pódcast. En última instancia, la creación de contenido es una forma de construir tu marca, atraer a tu público y ganar terreno en los motores de búsqueda.

Mailchimp ofrece una variedad de herramientas de creación de contenido. Entre las herramientas más populares de Mailchimp se encuentran: Creative Assistant, Plantillas de correo electrónico, Ayudante de línea de asunto, Gestor de contenido y herramientas de IA generativa.

-

Automatizar el proceso de creación de contenido es una solución eficaz que puede ahorrarte tiempo, aumentar la eficiencia y minimizar los costos, a la vez que te proporciona contenido personalizado y coherente. Puedes automatizar la creación de contenido mediante el uso de contenido dinámico de correo electrónico y la adopción de herramientas de redacción y diseño impulsadas por IA.

Estas son algunas formas en las que las herramientas de creación de contenido de Mailchimp pueden ayudarte a automatizar el proceso:

- Contenido dinámico: Con el contenido dinámico de correo electrónico, puedes automatizar la creación de contenido para asegurarte de que el contenido adecuado llega al público adecuado, incluso aunque se envíe de forma masiva. Esta función permite personalizar cada mensaje que envíes, eliminando la necesidad de crear un nuevo correo electrónico o mensaje de seguimiento para contactos específicos. Con el contenido dirigido, puedes enviar códigos promocionales a diferentes ubicaciones o mostrar nuevos productos según los grupos de edad.

- Generador de textos de IA: automatiza los textos, descubre ideas de contenido y recibe recomendaciones personalizadas respaldadas por datos. Experimenta con las variaciones de contenido y elige el texto más cautivador con el generador de textos de IA de Mailchimp.

- Creative Assistant: genera rápidamente diseños elegantes que sean fieles a tu marca con nuestra herramienta de diseño impulsada por IA. Puede automatizar los diseños de correos electrónicos, las páginas de destino y el contenido de redes sociales.

-

La creación de contenido en redes sociales se refiere al proceso de generar y publicar varios tipos de contenido específicamente para plataformas de redes sociales. Esto incluye crear publicaciones visualmente atractivas en redes sociales, texto descriptivo y atractivo, videos en redes sociales y más. El objetivo de las redes sociales es comunicarse eficazmente con tu público objetivo, generar interacción, impulsar el tráfico y, en última instancia, lograr objetivos de marketing como el conocimiento de la marca, la generación de clientes potenciales y la retención de clientes.

¿Necesitas contratar a alguien que te ayude? Nosotros te brindamos apoyo.

Desde un rápido diseño de plantilla hasta un servicio completo de gestión de campañas, nuestra comunidad mundial de más de 850 expertos de confianza lo cubre todo.

Transforma el contenido en ingresos

* Exención de responsabilidad

- La plataforma de email marketing núm. 1 impulsada por la IA: con base en los datos de diciembre de 2023 disponibles públicamente acerca de la cantidad de clientes de la competencia, que también hace publicidad del uso de IA para mejorar sus productos y servicios de email marketing y automatización.

- ROI 25 veces mayor : Basado en los ingresos de E-Commerce atribuibles a las campañas de Mailchimp para todos los usuarios con planes de pago de abril de 2023 a abril de 2024

- Intuit Assist : la funcionalidad Intuit Assist (beta) está disponible para ciertos usuarios con planes Premium, Standard y Legacy en determinados países solo en inglés. El acceso a Intuit Assist está disponible sin costo adicional en este momento. Los precios, términos, condiciones, funciones especiales y opciones de servicio están sujetos a cambios sin previo aviso. La disponibilidad de las funciones y la funcionalidad varían según el tipo de plan. Las funciones pueden estar ampliamente disponibles pronto, pero no representan ninguna obligación y no se debe confiar en estas para tomar una decisión de compra. Para obtener más información, consulta los distintos planes y precios de Mailchimp.

- La disponibilidad de las funciones y funcionalidades varía según el tipo de plan, que está sujeto a cambios. Para obtener más detalles, consulta planes y precios.