Canva

Crea diseños personalizados en Canva y compártelos sin problemas en Mailchimp una vez que los conectes.

- Precio

- Gratis

- Desarrollador

- Mailchimp

- Idiomas

- Español, Francés, Alemán, Español, Italiano, Portugués

-

#1

plataforma de automatización de marketing y correo electrónico*

-

> 99 %

promedio de entrega de correo electrónico

-

500millones

correos electrónicos que se envían cada día en promedio

Crea diseños personalizados en Canva que se sincronicen directamente con tu cuenta de Mailchimp para tu próxima campaña.

Conecta tus cuentas de Canva y Mailchimp

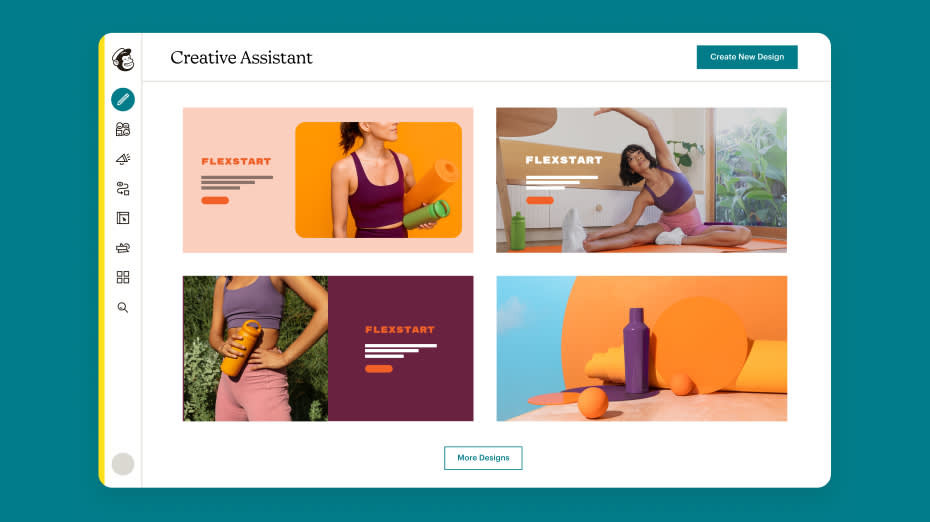

Crea y edita tus diseños en Canva, luego compártelos con Mailchimp después de conectarte. Accede a tus activos directamente en nuestro Content Studio para una experiencia de diseño más sencilla.

El complemento perfecto para nuestro Creador de correos electrónicos

Nuestro editor de arrastrar y soltar facilita el diseño de excelentes correos electrónicos, y Canva facilita agregar logotipos, banners, infografías, gifs, videos y más en la marca.

Agrega bellos diseños a tus correos electrónicos, sin necesidad de lentes

Hay más de 2 millones de fotos de archivo en Canva, junto con miles de plantillas para todo tipo de diseño, y es fácil incluirlas en tus correos electrónicos de Mailchimp después de conectarte.

¿Qué hace?

Estas son algunas formas populares de usar esta integración. Sus funciones y características varían según el plan.

-

Ahorrar tiempo en diseños

- Crea diseños personalizados para tus campañas en Canva y sincronízalos automáticamente con tu Content Studio de Mailchimp para facilitar el diseño con función de arrastrar y soltar, desde la idea hasta el “envío”.

- Accede fácilmente a tus archivos de marca Canva, junto con múltiples versiones de cada recurso, con plantillas de correo electrónico de Mailchimp y Creative Assistant.

-

Mejora tus campañas

- Haz que tus correos electrónicos destaquen con llamativos recursos de marca, como videos e imágenes de Canva, que muestren tus productos y servicios, para una apariencia profesionalmente diseñada.

- Diseña y distribuye sin problemas campañas de correo electrónico visualmente cautivadoras, gráficos para redes sociales y otros materiales de marketing personalizados que comuniquen el mensaje de tu marca y ayuden a atraer nuevos clientes.

Artículos sobre recursos

Conectar o desconectar Mailchimp for Canva

Conoce las herramientas de creación de contenido

Requisitos

Una cuenta de Canva para usar esta integración, que conectará una sola cuenta de Canva gratis o de pago a tu cuenta de Mailchimp.

Consulta Conecta o desconecta Canva para Mailchimp para obtener más información sobre la configuración y otras consideraciones en tu cuenta de Mailchimp antes de conectarte.

Millones de usuarios confían en nosotros para realizar su email marketing.

* Exención de responsabilidad

- **Integración:** Mailchimp y Canva se venden por separado. Integración disponible. La disponibilidad de las funciones y la funcionalidad varían según el tipo de plan. Para obtener más información consulta los planes y precios de Mailchimp.

- La mejor plataforma de email marketing: con base en los datos disponibles públicamente de diciembre de 2023 sobre el número de clientes de la competencia.