HERRAMIENTAS DE GESTIÓN DEL PÚBLICO

Personaliza cada interacción con el cliente con una segmentación precisa del público

Las herramientas de público de Mailchimp te ayudan a almacenar, segmentar y comprender a tus clientes para ofrecer las experiencias personalizadas más relevantes.

-

#1

plataforma de automatización de marketing y correo electrónico*

-

8 millones

recomendaciones respaldadas por datos con funciones impulsadas por IA*

-

500millones

correos electrónicos que se envían cada día en promedio

-

> 99 %

de entregabilidad del correo electrónico (promedio)

Coloca a tu público en el centro de tu marketing

Aprovecha los datos para entender a tus clientes

Identifica patrones entre sus contactos más valiosos con información en tiempo real sobre el comportamiento, los intereses, la interacción y la actividad de compra.

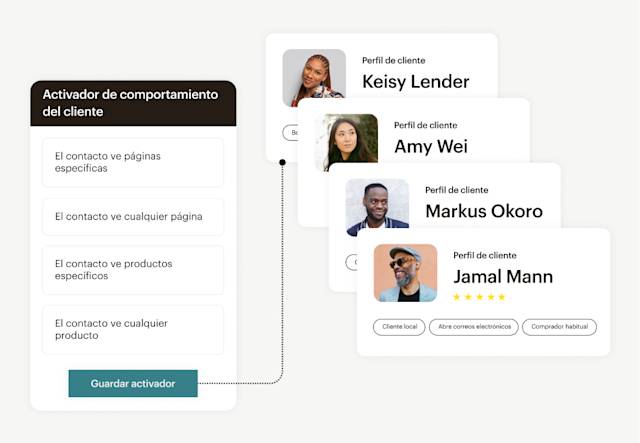

Personaliza las campañas de marketing con segmentos basados en los datos de los clientes

Envía el mensaje correcto en todo momento con una segmentación específica que aprovecha los datos de interacción y comportamiento de tus contactos.

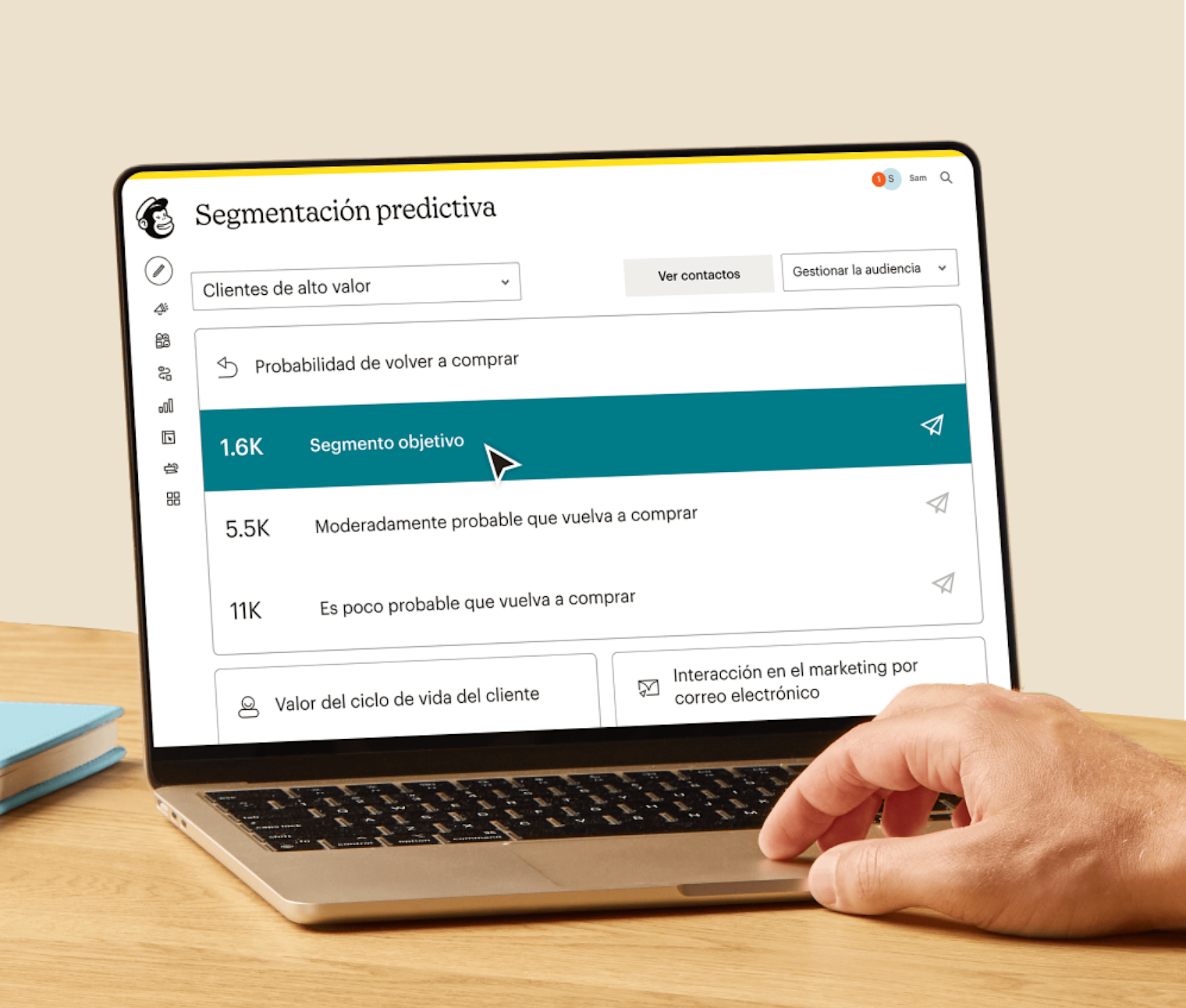

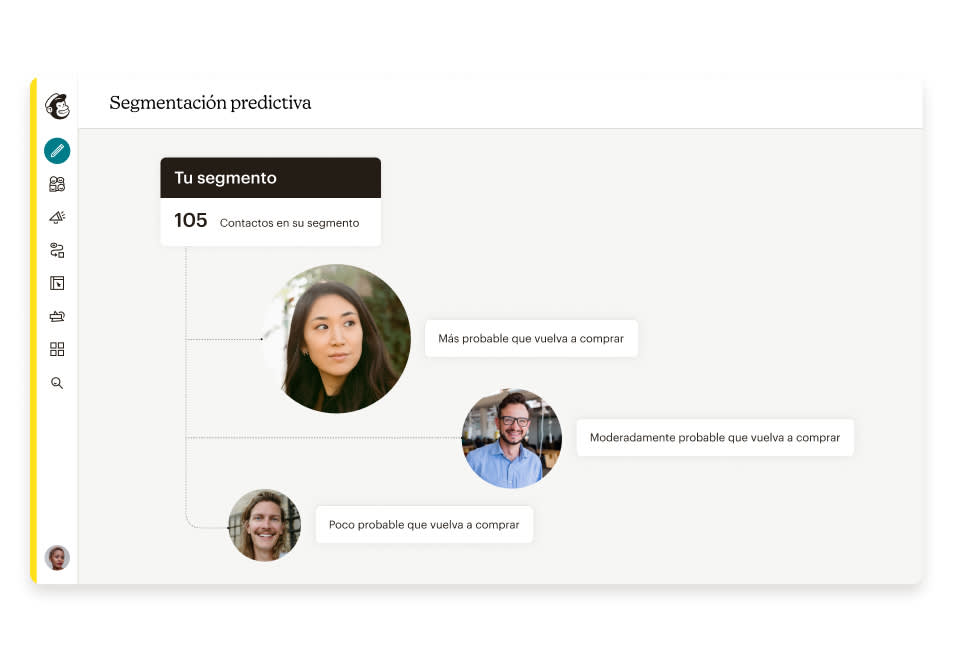

Usa la información prevista para impulsar la lealtad de los clientes

Impulsa la repetición de negocios dirigiéndote a los contactos en función de la demografía prevista prevista y del comportamiento en E-Commerce.

“La segmentación en Mailchimp es bastante sencilla, y su uso nos permitió dirigirnos mejor a grupos con diferentes campañas. Una mejor orientación nos ha permitido lograr mejores resultados”.

Lauren Korus , gestor de contenidos de Vacation Races US

Llega a los clientes adecuados en el momento correcto

Impulsa la interacción con herramientas de segmentación de clientes

La plataforma de correo electrónico de Mailchimp ayuda a predecir el comportamiento de los clientes, lo que permite a las empresas identificar segmentos de alto valor y generar hasta un 141% más de ingresos.*

Integra los datos de los clientes para impulsar las campañas

Conecta tu tienda y aprovecha las funciones de E-Commerce

basadas en datos para ayudarte a comprender a tu público, generar compras y crear relaciones duraderas con los clientes.

Ponte en marcha fácilmente con los servicios de onboarding personalizados

Obtén soporte guiado de un especialista en onboarding, disponible con un plan Standard o Premium.

Antes de empezar

A continuación, se incluyen algunos términos que debes conocer antes de comenzar a crear segmentos de público y qué puedes hacer con ellos.

-

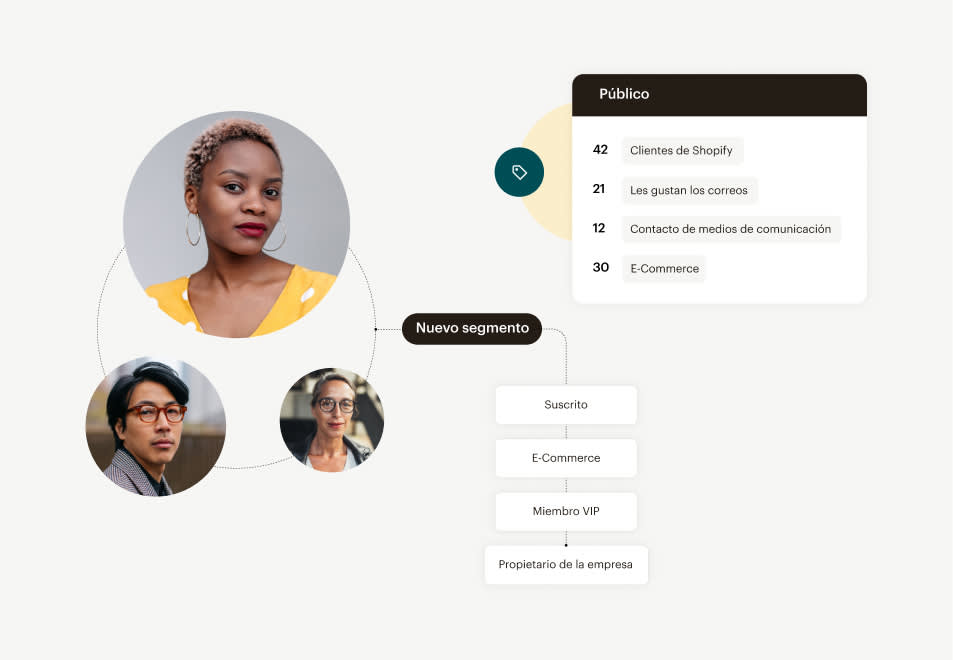

Público

Tu público es donde puedes almacenar, organizar y gestionar todos los datos de tus contactos.

-

Etiquetas

Las etiquetas son etiquetas para tus contactos que puedes usar para organizar tu público en función de lo que sabes sobre este.

-

Segmentos

Los segmentos te permiten enviar a listas específicas basadas en los datos de interacción, compras y sitios web de los contactos en tiempo real.

-

Grupos

Usa formularios de registro para preguntar a tus contactos sobre lo que les interesa y para organizarlos en grupos.

Premium

Escale rápidamente con incorporación dedicada, contactos ilimitados y soporte prioritario; diseñado para equipos.

Hablar con Ventas Seleccionaste más contactos de los que permite este plan

Desde

Desde $2450 al mes para {contacts} contactos

- Soporte telefónico y prioritario

- Plantillas de correo electrónico prediseñadas y codificadas a medida

- Pruebas de multivariante y A/B

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado especializado

- Segmentación predictiva

- Orientación conductual

Standard

Vende aún más con personalización, herramientas de optimización y automatizaciones mejoradas.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $130 al mes para {contacts} contactos

- Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas y codificadas personalizadas

- Pruebas A/B y multivariantes

- Recorridos automatizados del cliente mejorados

- Onboarding personalizado

- Segmentación predictiva

- Orientación conductual

Essentials

Envíe el contenido correcto en el momento adecuado con funciones de prueba y programación.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Gratis por 14 días

al mes†

Desde $85 al mes para {contacts} contactos

- 24/7 Soporte por correo electrónico y chat 24/7

- Plantillas de correo electrónico prediseñadas

- Pruebas A/B

- Recorridos del cliente automatizados básicos

-

Onboarding personalizado

-

Segmentación predictiva

-

Orientación conductual

Free

Crea fácilmente campañas de correo electrónico y aprende más sobre tus clientes.

Limite de contactos excedido Seleccionaste más contactos de los que permite este plan

Desde

Desde $0 al mes para {contacts} contactos

- Soporte por correo electrónico durante los primeros 30 días

- Plantillas de correo electrónico prediseñadas

-

Pruebas A/B

-

Recorridos automatizados del cliente básicos

-

Onboarding

-

Segmentación predictiva

-

Orientación conductual

† Se aplican recargos si se supera el límite de contactos o de envío de correos electrónicos. El envío del plan Free se pausará si se supera el límite de contactos o de envío de correos electrónicos.

Más informaciónLee más sobre las herramientas de gestión del público

Preguntas frecuentes

-

La segmentación en marketing es un tipo de estrategia que te permite agregar clientes potenciales y existentes en subgrupos basados en características compartidas, como edad, ubicación o comportamiento pasado de compra.

Como resultado, las empresas pueden dirigirse a estos segmentos de mercado de forma diferente con campañas que sean relevantes para sus necesidades. Segmentar a tu público también es valioso para atraer a los consumidores que tienen más probabilidades de realizar una compra o interactuar con tu marca.

En última instancia, la segmentación te permite desarrollar una comprensión más profunda de tu público, incluyendo quiénes son, sus necesidades, intereses y comportamiento, para que puedas crear una estrategia de marketing más eficaz.

-

Dado que tus campañas de marketing no van a ser igual de relevantes para todas las personas de tu lista de contactos, conviene crear segmentos de público basados en necesidades, creencias compartidas, comportamiento en línea, etc.

Las variables de marketing te ayudan a dividir al público en segmentos y te proporcionan posibles categorías en las que agrupar tus contactos. Los cuatro tipos principales de segmentación de mercado incluyen datos demográficos, geográficos, psicográficos y conductuales.

Un ejemplo de variable de segmentación de marketing sería la edad. De este modo, si un segmento en particular está compuesto por adolescentes de la generación Z, puedes usar un lenguaje coloquial y jerga popular en tus campañas. También puedes aprovechar a influencers y celebridades para atraer a más consumidores con ideas afines a tu marca.

-

La segmentación de público es una estrategia de marketing basada en identificar subgrupos dentro del público objetivo para enviar mensajes más personalizados y crear vínculos más fuertes.

Los subgrupos pueden estar basados en datos demográficos como la ubicación geográfica, la identidad de género, la edad, el origen étnico, los ingresos o el nivel de educación formal. Los subgrupos también pueden basarse en conductas como el historial de compras. La psicografía entra en juego cuando tienes acceso a información sobre los tipos de personalidad, valores, actitudes e ideas de tu público. Un ejemplo es crear segmentos separados para la gente en función de si son familiares frente a individualistas, líderes frente a seguidores, o aventureros frente a caseros.

-

La segmentación del público es una potente herramienta para que las empresas y organizaciones comprendan mejor su mercado objetivo y adapten sus labores de marketing para satisfacer las necesidades de los clientes. Los principales beneficios de la segmentación del público incluyen:

Mejor definición del objetivo: la segmentación del público permite a las empresas identificar y dirigirse a segmentos de clientes específicos con mensajes personalizados que tienen más probabilidades de calarles.

Mayor ROI: al dirigirse a un segmento específico, las empresas pueden aumentar su retorno de la inversión al centrar sus recursos en los segmentos más rentables.

Mayor fidelidad de los clientes: al comprender las necesidades de cada segmento, las empresas pueden crear experiencias más personalizadas para aumentar la satisfacción del cliente y fomentar la fidelidad y la retención del cliente.

Mejor información: la segmentación del público proporciona a las empresas información valiosa sobre el comportamiento y las preferencias del cliente, que se puede utilizar para mejorar los productos y servicios.

-

Cuando un cliente siente que un mensaje se ha escrito para él, es más probable que se muestre receptivo a lo que tienes que decirle. La segmentación permite ese tipo de personalización.

¿Pero por dónde empezar? La mayoría de estrategias de marketing comienzan con la creación de un perfil de cliente o una personalidad ficticia que represente al cliente ideal. Ese perfil puede incluir dónde trabaja esa persona, si está casada y cuáles son sus aficiones.

Los perfiles te ayudan a comunicarte con tus clientes a su nivel, sobre todo cuando se trata de identificar sus problemas, y cómo puedes ayudarles a resolverlos. Una vez que crees esos perfiles, puedes separarlos en grupos.

-

La segmentación del público es una parte importante de cualquier estrategia de marketing. Estos consejos pueden resultar útiles para crear segmentos de público eficaces:

Identificar las características clave: empieza por identificar las características clave de tu público objetivo, como edad, sexo, ubicación, intereses, etc.

Analizar los datos de los clientes: analiza los datos de encuestas de clientes, análisis de sitios web y otras fuentes para comprender mejor las necesidades y preferencias de tus clientes.

Crear segmentos lógicos: una vez que hayas identificado las características clave, crea segmentos lógicos basados en esas características. Por ejemplo, podrías segmentar a tu público en "profesionales jóvenes" y "sénior".

Probar y perfeccionar: Prueba tus segmentos y perfecciónalos con el tiempo en función de los comentarios de los clientes. Utiliza una herramienta de análisis de marketing para medir el rendimiento de tus segmentos. El análisis frecuente de segmentación de clientes ayudará a garantizar que tus segmentos sean lo más precisos y eficaces posible.

-

La segmentación del público en el marketing por correo electrónico es cuando una empresa divide a los suscriptores de su lista de correo electrónico en grupos más pequeños en función de factores como las acciones realizadas, los patrones de comportamiento, los intereses, la edad, la ubicación, etc. Con las herramientas de segmentación del marketing por correo electrónico, como Mailchimp, los profesionales del marketing pueden gestionar y segmentar fácilmente a su público en función de una serie de factores cruciales. Esto te permite desarrollar campañas de marketing por correo electrónico más sofisticadas y personalizadas que conecten con tu público.

-

Al hacer uso de las herramientas de segmentación de clientes, los profesionales del marketing pueden crear mejores campañas de marketing por correo electrónico que atraigan más eficazmente a los compradores. Al fin y al cabo, cada persona es diferente, por lo que enviar correos electrónicos de marketing genéricos que traten de atraer a cada uno de los suscriptores de tu lista de correo electrónico rara vez será una estrategia eficaz.

Segmentar tu público facilita la creación de correos electrónicos personalizados y mejora las conversiones. Además, las herramientas de segmentación pueden ayudar a las empresas a vender a compradores que se encuentran en diferentes etapas del ciclo de ventas. Mediante la segmentación del marketing por correo electrónico, puedes enviar fácilmente correos electrónicos de bienvenida a los nuevos suscriptores, correos electrónicos de carrito abandonado a los compradores indecisos y correos electrónicos de seguimiento a los clientes recientes.

-

Para aquellos que se preguntan qué son los segmentos de clientes, el uso final de los segmentos está diseñado para ayudar a categorizar y organizar a los consumidores, clientes y clientes potenciales en varios grupos.

Cuando te preguntes cómo crear segmentos de clientes, debes considerar una estrategia que se basará en las necesidades de tu negocio y en varias características de tu organización.

En muchos casos, cuando vendes a otras empresas, algunos de los factores que se pueden utilizar cuando intentas crear nuevos segmentos de clientes incluirán el tamaño de las empresas a las que te diriges, la ubicación de la empresa, el sector en el que operan, el número de empleados y si la empresa ha comprado productos similares en el pasado.

Si estás intentando vender directamente a personas, también será ventajoso idear otras características similares para ayudar a organizar tus esfuerzos de ventas.

-

Los segmentos de clientes son una forma de encontrar eficazmente tu público objetivo para impulsar la interacción y aumentar las conversiones. Puedes utilizar varios tipos de segmentación para garantizar que los mensajes de marketing adecuados lleguen a tus clientes, incluida la segmentación demográfica, conductual, geográfica y psicográfica.

-

En general, la segmentación de clientes es una estrategia que se centra en dividir a los clientes actuales y potenciales en diferentes categorías.

Las técnicas y la metodología de categorización variarán en función de las necesidades individuales de tu negocio. Cuando tienes un proceso de segmentación de clientes adecuado y utilizas una herramienta de segmentación de clientes, puede ayudar a mantener tus sistemas de CRM organizados y permitirte restringir tu estrategia de marketing de forma más eficaz.

-

Las herramientas de segmentación de clientes (también conocidas como software de segmentación de clientes) son aplicaciones utilizadas para identificar y analizar grupos de clientes en función de características comunes como la demografía, el comportamiento de compra, los intereses y más. El uso de una herramienta de segmentación de clientes puede ayudar a las empresas a comprender mejor su base de clientes y crear campañas de marketing digital más específicas. Las herramientas comunes de segmentación de clientes incluyen plataformas analíticas, sistemas de CRM y software de encuestas.

-

Las herramientas de segmentación de clientes ayudan a las empresas a comprender mejor su base de clientes y adaptar sus estrategias de marketing y ventas para dirigirse a tipos de clientes específicos. Otras herramientas de segmentación de clientes incluyen:

Herramientas de geolocalización: Estas herramientas permiten a las empresas segmentar a los clientes según su ubicación geográfica. Esto puede ayudar a las empresas a dirigirse a los clientes en áreas específicas con mensajes de marketing más relevantes.

Herramientas de segmentación demográfica: estas herramientas permiten a las empresas segmentar a los clientes según criterios demográficos como edad, sexo, ingresos y ocupación. Esto puede ayudar a las empresas a comprender mejor su base de clientes y dirigirse a los clientes con mensajes más relevantes.

Herramientas de segmentación conductual: estas herramientas permiten a las empresas segmentar a los clientes en función de su comportamiento pasado y su historial de compras. Esto puede ayudar a las empresas a dirigirse a los clientes con ofertas y descuentos más relevantes.

Herramientas de segmentación psicográfica: estas herramientas permiten a las empresas segmentar a los clientes según su estilo de vida, valores, actitudes e intereses. Esto puede ayudar a las empresas a dirigirse a los clientes con contenido y mensajes más relevantes.

Herramientas de segmentación de redes sociales: estas herramientas permiten a las empresas segmentar a los clientes en función de su actividad en las redes sociales. Esto puede ayudar a las empresas a dirigirse a los clientes con contenido y ofertas más relevantes.

-

El machine learning se puede utilizar para segmentar a los clientes en función de diversos datos. Por ejemplo, la IA puede agrupar a los clientes con características similares en función de la demografía y los comportamientos. Sin embargo, si añades los datos de los clientes que recopilas en tu tienda en línea, se pueden utilizar para segmentar a los clientes en función de su comportamiento de compra anterior.

Por ejemplo, Mailchimp utiliza análisis predictivos para estudiar el comportamiento de compra anterior y predecir contactos con un valor vitalicio del cliente (customer lifetime value, CLV) alto, moderado o bajo. A continuación, esas predicciones se utilizan para segmentar a tus clientes automáticamente.

Respecto al cerebro humano, la tecnología de la IA puede encontrar, de forma automática, patrones en los datos de los clientes, lo que te permite segmentarlos en función de información que ni siquiera sabías que existía y crear campañas de marketing más personalizadas.

El uso de machine learning para las herramientas de segmentación de clientes aumenta la eficacia y es altamente escalable. Los métodos manuales de examinar los datos de los clientes para encontrar similitudes pueden funcionar para pequeñas empresas, pero no es lo bastante eficiente cuando tienes decenas de miles de clientes.

-

La segmentación del correo electrónico es el proceso de dividir y separar a los suscriptores de correo electrónico en grupos o segmentos en función de criterios que utilizan etiquetas y segmentos en tu plataforma de marketing por correo electrónico.

Los suscriptores de correo electrónico pueden terminar en múltiples segmentos, dependiendo de factores como la edad, la ubicación y el comportamiento. La segmentación es un tipo de personalización, pero no es el mismo concepto. Aunque el uso de la segmentación y la personalización son algunos de los mejores consejos de marketing por correo electrónico, hay varias diferencias clave.

Por ejemplo, la personalización adapta el contenido de los correos electrónicos para que sea más personal, lo que puede incluir añadir elementos como el nombre de un suscriptor o las compras recientes que ha realizado. Por otro lado, la segmentación del correo electrónico se centra más en agrupar a miembros similares del público para enviarles una campaña de correo electrónico mejor dirigida.

La segmentación de marketing por correo electrónico tiene como objetivo crear contenido que sea más relevante para tu público en función de los criterios que establezcas. Por ejemplo, si vendes productos para mascotas, podrías crear dos segmentos: dueños de perros y gatos. La segmentación del correo electrónico depende de tu capacidad de crear diferentes contenidos para cada categoría de clientes para ayudarte a crear una lista de correo electrónico.

Por desgracia, algunas empresas siguen enviando el mismo correo electrónico con el mismo contenido a todas las personas de su lista, proporcionando una experiencia menos personal a todos sus suscriptores de correo electrónico. La mayoría de esos correos electrónicos no se leen, y no se toman medidas porque son demasiado generales para hablar con un único grupo de miembros del público.

Cuanto más pequeños sean tus segmentos, más adaptados podrán estar a un segmento de clientes individual, y así ayudarte a atraer más clientes a tu sitio web. Los efectos de la segmentación de listas se traducen en que puedes crear campañas de correo electrónico más específicas basadas en varios factores, que puedes determinar recopilando datos sobre tu público.

¿Necesitas contratar a alguien que te ayude? Nosotros te brindamos apoyo.

Desde un rápido diseño de plantilla hasta un servicio completo de gestión de campañas, nuestra comunidad mundial de más de 850 expertos de confianza lo cubre todo.

Millones de usuarios nos confían su marketing por correo electrónico. Tú también puedes.

*Exención de responsabilidad

- La mejor plataforma de email marketing: con base en los datos disponibles públicamente de diciembre de 2023 sobre el número de clientes de la competencia.

- Más de 8 millones de recomendaciones respaldadas por datos : basado en datos de 2022 de los siguientes productos: Recomendaciones de productos, Optimización de la hora de envío, Pruebas A/B, Segmentación del CLV, Segmentación de probabilidad de compra y PBJ.

- Segmentación prevista: Hasta 141 % más de ingresos para las tiendas conectadas de los usuarios que usan correos electrónicos segmentados predictivos en comparación con correos electrónicos segmentados no predictivos para el período del 1 de enero de 2022 al 1 de julio de 2023. Solo para planes Standard y Premium.

- Onboarding personalizado: los servicios de onboarding varían por plan y están disponibles para usuarios nuevos o actualizados con un plan Standard o Premium para los primeros 90 días después de creada o actualizada la cuenta. Los servicios de onboarding se ofrecen actualmente en inglés, español y portugués para los planes Premium, y en inglés para los planes Standard.

- La disponibilidad de las funciones y la funcionalidad varían según el tipo de plan. Para obtener más detalles, consulta planes y precios.